2024 Irs Payment Schedule – The IRS again delays law that would have required Ticketmaster, Venmo, and others to issue 1099-Ks to those with more than $600 in revenue in 2023. . But for 2024, more of your income will fall into lower tax brackets. For instance, in the 2023 tax year single tax filers will pay 10% on their first $11,000 of taxable income. In 2024 .

2024 Irs Payment Schedule

Source : thecollegeinvestor.com

SSI Payment Schedule 2024 Stimulus Checks Dates, How to Apply for

Source : www.incometaxgujarat.org

When To Expect My Tax Refund? The IRS Tax Refund Calendar 2024

Source : thecollegeinvestor.com

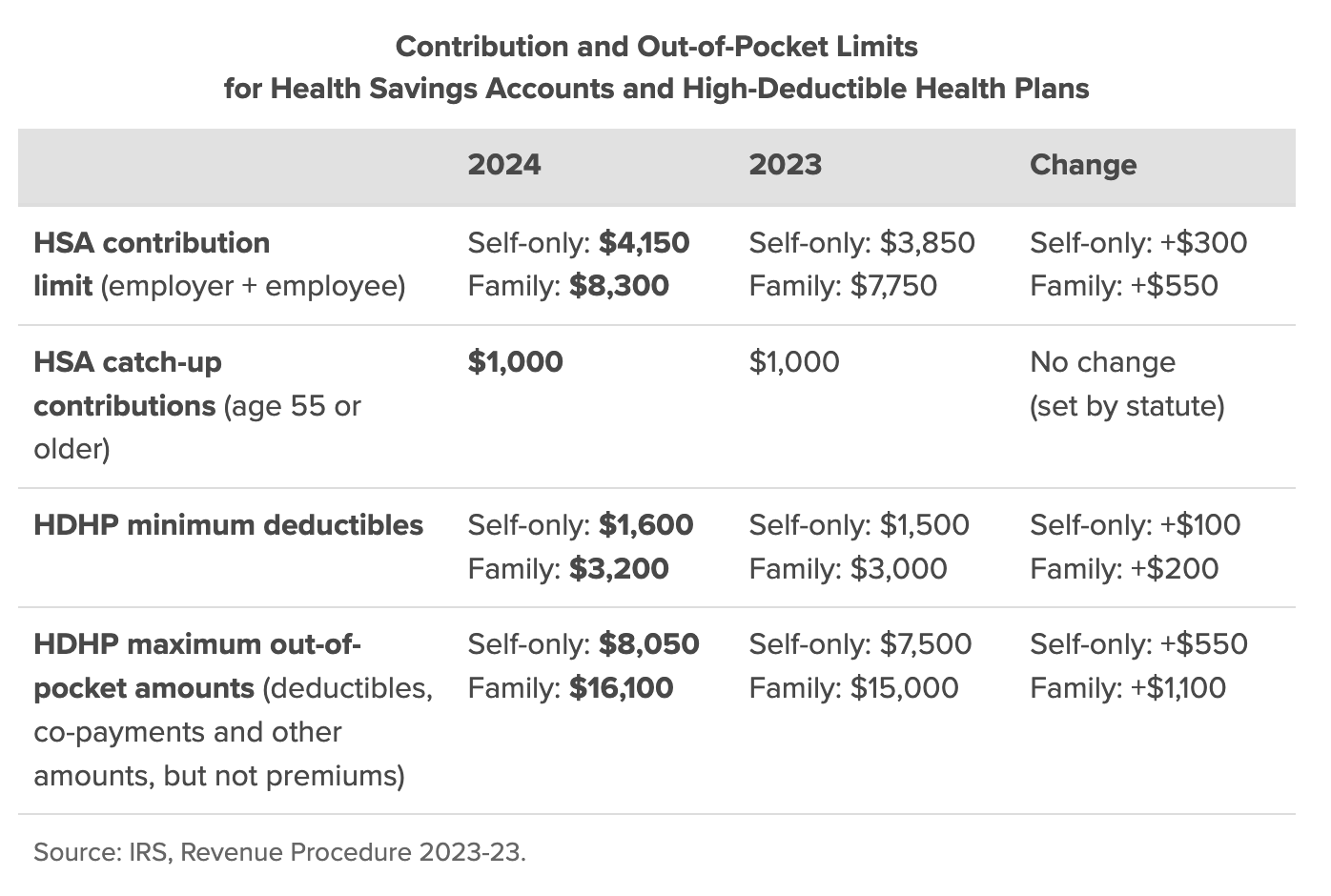

2024 HSA Contribution Limits Claremont Insurance Services

Source : www.claremontcompanies.com

IRS Announces 2024 Retirement Plan Contribution, Benefit Limits

Source : www.payroll.org

IRS Tax Refund Schedule Dates for 2024: A Guide for Taxpayers

Source : www.wate.com

Publication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.gov

FSA Archives Admin America

Source : adminamerica.com

IRS to Launch Free E Filing Program in 2024. Here’s What to Know

Source : www.nbcboston.com

Child Tax Credit Payment Schedule 2024, Stimulus Check Monthly

Source : childtaxcredit.us

2024 Irs Payment Schedule When To Expect My Tax Refund? The IRS Tax Refund Calendar 2024: The Internal Revenue Service has announced that income tax brackets taxes you pay from your income. The rates currently are set at 10%, 12%, 22%, 24%, 32%, 35% and 37%. For 2024, the lowest . The IRS has announced the annual inflation adjustments for the year 2024, including tax rate schedules, tax tables and cost-of-living adjustments. These are the official numbers for the tax year .